You've been trading for a while now. You have a strategy that works—at least, it seems to work when you execute it properly. You've heard about algorithmic trading, and you're wondering: should I automate this?

It's a fair question, but here's the thing most people won't tell you: not every trading strategy should be automated.

I know that sounds counterintuitive, especially when the algo trading world makes automation seem like the answer to everything. But the truth is more nuanced. Some strategies thrive under automation, becoming more profitable and consistent. Others? They lose their edge the moment you try to encode them into rules.

So how do you know which category your strategy falls into?

Let's figure it out together.

The Fundamental Question: Can You Articulate Your Rules?

Before we get into the fancy criteria, let's start with the most basic test. Grab a notebook and try this exercise:

Write down, step by step, exactly how you make trading decisions.

Not vague guidelines like "I buy when momentum is strong." I mean specific, actionable rules: "I buy when the 50-day moving average crosses above the 200-day moving average, RSI is between 40 and 60, and volume is at least 1.5 times the 20-day average."

If you can do this—if you can clearly articulate your entry conditions, exit rules, position sizing logic, and risk management parameters—you've passed the first test. Your strategy might be automatable.

If you're struggling to write down concrete rules, if your decisions involve lots of "it depends" or "you just have to feel it," that's not necessarily bad. It just means your strategy is discretionary by nature, and automation probably isn't the right path.

The Pattern Recognition Test

Here's another way to think about it. Close your eyes and picture your last ten trades. Now ask yourself:

Did you follow the same process each time, or were they all different?

Systematic traders—the ones best suited for automation—tend to repeat the same pattern. They might trade different instruments or different timeframes, but the decision-making framework stays consistent. "When I see X pattern plus Y indicator reading, I do Z."

Discretionary traders, on the other hand, might use technical analysis as a starting point, but they layer in context that's hard to codify. Market sentiment. News flow. Intuition developed over years. The "feel" of price action.

Neither approach is better. But only one lends itself to automation.

Think of it this way: if a bright but inexperienced trader sat next to you and watched you trade for a month, could they then replicate your decisions with 80% accuracy? If yes, your strategy is probably systematic enough to automate. If no, you're relying on expertise that's difficult to encode.

Time and Attention: The Hidden Cost

Let's talk about something people rarely consider when evaluating automation: your time commitment.

Ask yourself honestly: how much time do you currently spend executing your strategy?

If you're glued to your screen all day, manually watching for setups, constantly monitoring positions, and adjusting orders... automation might dramatically improve your life. These are repetitive tasks that algorithms excel at.

But here's the flip side: if you only trade a few times a month, and each trade requires deep analysis of fundamentals, earnings reports, and industry trends... automation might create more work than it saves. You'd spend all your time maintaining the system rather than actually trading.

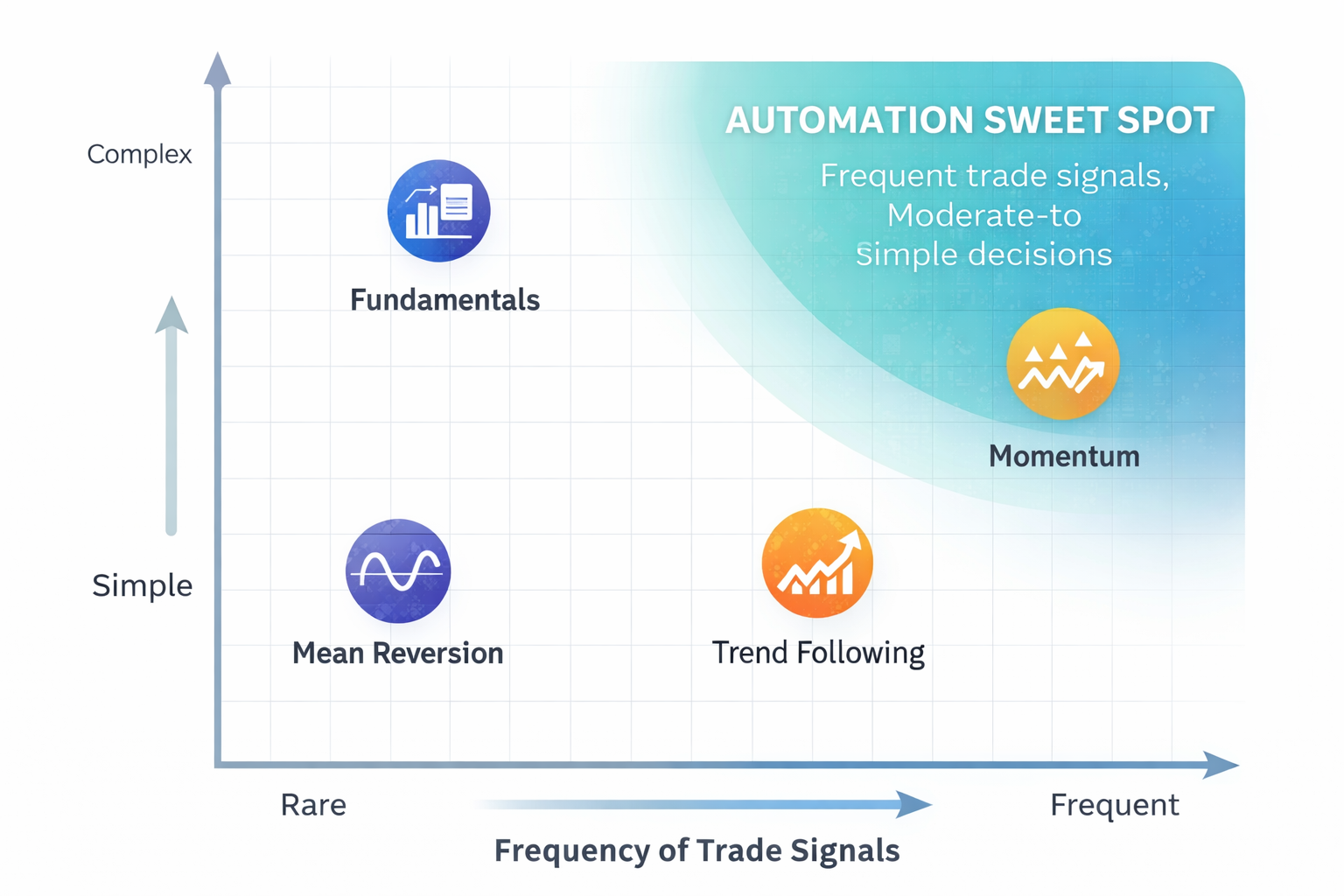

There's a sweet spot. Strategies that generate signals frequently (daily or weekly) but don't require complex contextual analysis are ideal candidates for automation. You get the benefit of consistent execution without the burden of constant monitoring.

The Emotion Factor: Are You Your Own Worst Enemy?

This is going to sting a bit, but it's important.

Do you follow your own rules?

Most traders, if they're honest, will admit they don't—at least not consistently. You have a stop-loss at 2%, but you convince yourself to give it "just a little more room" when a trade goes against you. You have a rule about position sizing, but when you feel really confident, you double up. You know you should exit when your profit target hits, but greed whispers "it might go higher."

If this sounds familiar, automation might be the best thing that ever happened to your trading.

Algorithms don't get scared. They don't get greedy. They don't convince themselves "this time is different." They follow the rules you gave them, every single time, without exception.

I've seen traders with mediocre strategies become consistently profitable simply by automating them. Not because the strategy improved—but because the execution did. The emotions disappeared.

On the other hand, if you're already highly disciplined and your manual execution is flawless, automation might not add much value. You're already getting the main benefit—consistent rule-following—without needing the technology.

Backtesting: The Reality Check

Here's a critical question that will tell you a lot about whether your strategy is automation-ready:

Have you backtested it?

If you haven't, that's your first homework assignment. Not because backtesting guarantees future success (it doesn't), but because the process of backtesting forces you to clarify your rules.

When you try to backtest a strategy, all the ambiguities become obvious. "I buy when the trend is strong" doesn't work—you need to define "strong." "I exit when momentum weakens" isn't enough—you need specific criteria for "weakens."

The act of making your strategy testable makes it automatable. They're almost the same thing.

And here's the bonus: if your strategy performs well in backtesting across multiple time periods and market conditions, that's a strong signal it's worth automating. If it only works in one specific type of market, or if small parameter changes dramatically affect results, that's a warning flag.

For a deeper dive into proper backtesting methodology, our guide on Backtesting Fundamentals: The Power of Strategic Trading covers the essential concepts you need to know.

The Complexity Question: Simple vs. Sophisticated

There's a common misconception that automated strategies need to be complex. Multiple indicators, fancy math, machine learning models.

Not true.

Some of the most profitable automated strategies are remarkably simple. Moving average crossovers, Breakout systems, Mean reversion on certain timeframes, etc. The power isn't in the complexity—it's in the consistent execution.

Here's how to think about it: can you explain your strategy to someone in under five minutes, and would it still sound like it should work? If yes, that's probably the right level of complexity for automation.

If it takes you an hour to explain all the conditions, exceptions, and special cases... you might want to simplify before automating. Overly complex strategies are harder to maintain, more prone to bugs, and often perform worse in live markets than they did in testing.

Market Conditions and Adaptability

This is where things get tricky.

Some strategies work in trending markets but fail in ranging markets. Others thrive during high volatility but struggle when things calm down. Still others depend on specific market microstructures that can change over time.

Ask yourself: does my strategy need to adapt to changing market conditions?

If the answer is yes, and that adaptation requires human judgment and interpretation, automation becomes challenging. You'd need to build in regime detection, adaptive parameters, and potentially multiple strategy variants that activate under different conditions.

That's not impossible, but it's significantly more complex than automating a strategy that works consistently across different market environments.

The most automation-friendly strategies are those that have shown reasonable performance across various market conditions. They might perform better in some environments than others, but they don't completely break down when conditions change.

Position Sizing and Risk Management

Here's something people often overlook: can you clearly define your position sizing rules?

For example, some traders intuitively adjust their position sizes based on their confidence level. They might risk 1% of capital on a "decent" setup but bump it to 2% on a "great" setup.

The problem? "Confidence level" is subjective. It's not something you can easily teach an algorithm.

If your position sizing is fixed ("I always risk 1% per trade" or "I always trade 100 shares"), that's easily automated. If it's dynamic but rule-based ("I risk 1% in normal volatility, 0.5% when VIX is above 30"), that's still automatable.

But if it's intuitive and context-dependent, you'll struggle to automate it without losing an important edge.

The same applies to risk management. Can you clearly articulate when you'll cut losses, when you'll let winners run, when you'll hedge, when you'll sit out of the market entirely? If yes, automation is feasible. If these decisions involve subtle judgment calls, maybe not.

The Execution Advantage

Let's talk about something practical: execution quality.

If your strategy involves trading highly liquid instruments during regular market hours, your manual execution is probably fine. You're not fighting for milliseconds.

But if you're trading less liquid markets, or trying to capture small moves, or operating across multiple instruments simultaneously, automation can provide a real execution advantage. Algorithms don't hesitate. They don't fat-finger entries. They can watch dozens of setups simultaneously and act instantly when conditions are met.

This is especially relevant for strategies that require precise timing. If your edge depends on getting in at exactly the right price, human execution introduces slippage that can eat into your profits.

On the flip side, if your strategy is forgiving on entry prices—if getting in 0.5% higher or lower doesn't materially affect your results—the execution advantage of automation is less compelling.

The Maintenance Reality

Here's something the algo trading promotional material won't emphasize: automated strategies require maintenance.

Markets evolve. Volatility changes. Correlations shift. What worked last year might not work this year. Even fully automated strategies need periodic review and adjustment.

Ask yourself honestly: am I willing to monitor, test, and potentially modify my automated strategy on an ongoing basis?

If you're imagining a "set it and forget it" solution, let me burst that bubble now. Successful automation requires ongoing attention. Not the minute-by-minute attention of manual trading, but regular check-ins to ensure the strategy is still performing as expected.

If you're not willing to do that maintenance work, you're better off staying manual. At least then you're actively engaged with your trading decisions rather than blindly trusting an algorithm that might be deteriorating.

The Learning Curve Consideration

Let's be practical about the path to automation.

If you're currently trading manually, there's a learning curve to automation. You'll need to learn platform tools, understand backtesting principles, potentially grasp some basic programming concepts (even if you're using no-code platforms), and develop comfort with letting algorithms execute on your behalf.

For some traders, this learning curve is energising. It's a new challenge, a way to evolve their trading. For others, it's a barrier that prevents them from ever successfully automating.

Be honest with yourself: am I genuinely interested in learning the automation side, or am I just hoping to outsource the work?

If it's the latter, you might want to reconsider. Successful automation still requires your engagement and understanding. You can't truly outsource trading—you can only change the nature of your involvement.

For those just starting their algorithmic trading journey, our guide on Algo Trading for Beginners: How to Start Algo Trading as a Retail Investor provides a solid foundation for what to expect.

The Real Automation Sweet Spot

After considering all these factors, we can identify the strategies that are most automation-friendly:

Ideal candidates for automation:

- Rule-based entries and exits that can be clearly articulated

- Frequent enough signals to justify the setup effort (weekly or more)

- Consistent decision-making process across all trades

- Historical performance that backtests well across multiple conditions

- Risk management that follows clear, predefined parameters

- Emotions or discipline issues affecting your manual execution

- Time-intensive monitoring requirements

Probably better kept manual:

- Heavy reliance on fundamental analysis and company research

- Context-dependent decisions requiring industry knowledge

- Rare, high-conviction trades (monthly or less frequent)

- Strategies that require constant adaptation to changing conditions

- Position sizing based on subjective confidence levels

- Profitable manual execution with strong emotional discipline

Most traders will find themselves somewhere in between. Maybe your core strategy is automatable, but you want to maintain discretionary override capability. Maybe you automate the entry and initial stop-loss, but manually manage the exit.

That's perfectly fine. Automation doesn't have to be all-or-nothing.

The Hybrid Approach: Best of Both Worlds?

Here's something worth considering: you don't have to choose exclusively between manual and automated trading.

Many successful traders use a hybrid approach. They automate the mechanical parts of their strategy—the scanning for setups, the initial entries, the stop-losses—but maintain discretionary control over position sizing, profit-taking, or the decision to override the system in unusual circumstances.

This hybrid approach can be powerful. You get the consistency and emotional discipline of automation for the routine decisions, while preserving your judgment and experience for the nuanced ones.

The key is being intentional about which parts you automate and which you keep manual. Don't automate something just because you can. Automate the parts where algorithms genuinely add value.

Making the Decision

So, let's bring this all together with a practical framework.

Your strategy is probably worth automating if:

- You can write down your complete trading process with specific, testable rules

- You generate enough signals to make automation worthwhile (at least weekly)

- Your manual execution suffers from emotional or discipline issues

- You spend significant time monitoring markets for setups

- Your strategy has shown consistent logic across different market conditions

- You're willing to invest time in learning automation tools and maintaining your system

Your strategy is probably better kept manual if:

- Your decisions involve significant subjective judgment or expertise

- You trade infrequently based on deep fundamental research

- Your strategy requires constant adaptation to changing contexts

- You're highly disciplined and already execute your rules consistently

- You're not interested in learning automation tools and processes

- Your edge comes from information processing that's hard to codify

And remember: there's no shame in manual trading. Some of the world's most successful traders are purely discretionary. The goal isn't to automate for automation's sake—it's to trade in the way that plays to your strengths and gives you the best chance of consistent profitability.

Testing the Waters

If you're still unsure, here's my suggestion: start small.

Don't try to fully automate your entire trading operation on day one. Instead, pick one simple, rule-based component of your strategy and automate just that part. See how it feels. Learn the tools. Build confidence.

For example, maybe you automate just your entry signals while keeping exits manual. Or automate your scanning for setups while keeping the actual trading decisions manual. Or run an automated version of your strategy alongside your manual trading to compare results.

This incremental approach gives you real experience with automation without the risk of fully committing before you know if it's right for you.

The Bottom Line

Algorithmic trading is a powerful tool, but it's not a universal solution. The right question isn't "should I automate?" but rather "does automation align with how my strategy actually works?"

If you're trading systematically, generating frequent signals, struggling with execution discipline, or spending hours monitoring markets for setups, automation probably makes sense. You'll likely see improved consistency, reduced emotional stress, and better overall results.

If you're trading based on deep research, nuanced judgment, or rare high-conviction opportunities, manual trading is probably your best path. Your edge comes from things that are difficult to automate, and trying to force it into an algorithmic framework might actually hurt your performance.

The traders who succeed with automation are those who honestly assess whether their approach is suited for it—and have the patience to implement it properly when it is.

For those looking to explore their options, our article on How to Choose the Best Algo Trading Platform provides guidance on what to look for. And if you want to understand different strategic approaches that work well with automation, our series on advanced techniques like Long Iron Condor and Short Straddle strategies shows how complex setups can be systematically executed.

The decision to automate is personal and strategic. Take your time with it. Test thoroughly. And remember: the best trading approach is the one that works for you, matches your lifestyle, and gives you confidence in your execution.

That might be fully automated. It might be completely manual. Or it might be somewhere in between.

And that's perfectly fine.