One Algo Trading Platform. Built for Traders, Advisors & Enterprises.

Whether you're a Retail Trader, Quant Developer, RA/RIA, Broking House, or a Fintech firm—AlgoBulls gives you the tools, infrastructure, and compliance to build, deploy, and scale algorithmic strategies with ease - without servers, delays, or complexity.

💡 Whether you're looking to automate your own trades or offer algo solutions to your existing user base at any scale — we have end-to-end solutions tailored for you.

- AlgoBulls Overview

- Odyssey Overview

- Phoenix Overview

Who is algobulls for?

Retail Traders & Investors

Trade smarter using ready-made strategies, create your own using forms/AI, or let experts build it for you —no code needed.

Explore Solutions for Retail TradersQuant Developers & Coders

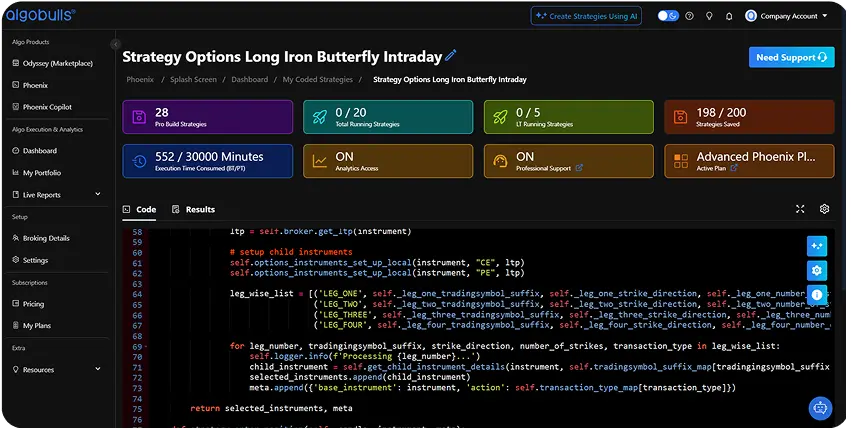

Code in Python. Use Jupyter Notebooks, CLI, ML libraries, and deploy live—without managing servers.

Explore Solutions for DevelopersStrategy Creators

Whether you're a Research Analyst, trader, or quant — share your logic and get your strategy built, deployed, and monetised on our platform.

Explore Solutions for CreatorsBroking Houses & Fintech Firms

Launch your own white-labeled algo trading desk. Scalable, compliant, and deployment-ready.

Explore Solutions for EnterprisesHedge Funds, RIAs & Asset Managers

Automate portfolio strategies, reduce manual execution risk, and offer enhanced execution algos to clients under your own brand.

Explore Solutions for EnterprisesProprietary & Quantitative Trading Desks

Deploy proprietary models securely using our infra. Scale execution with full control, zero infra burden, and real-time analytics.

Explore Solutions for EnterprisesWhat Sets us apart?

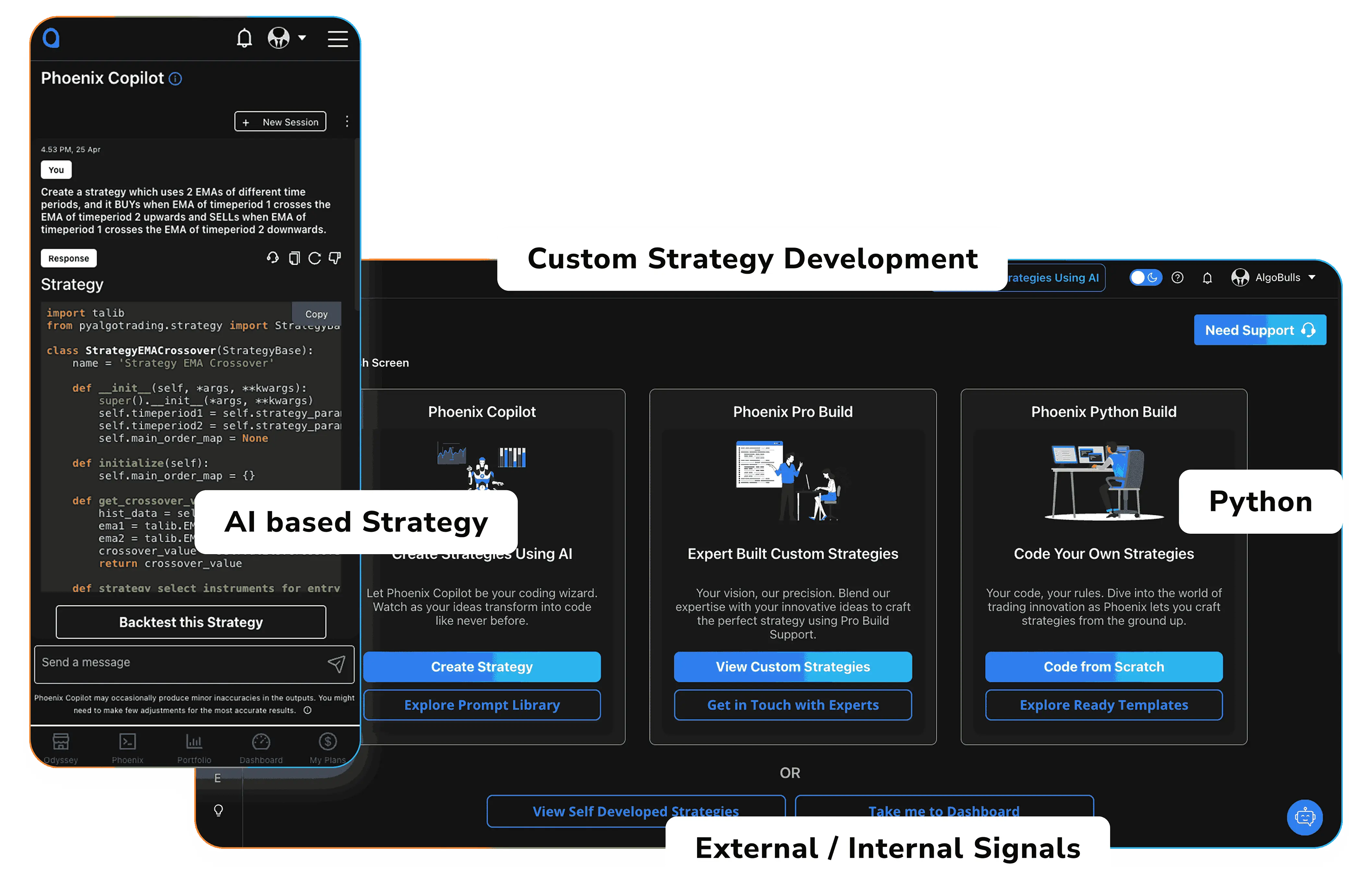

AI + Full Code + No-Code Strategy Building

Phoenix Suite for everyone to create your custom strategy with maximum flexibility and choice.

Machine Learning Strategy Support

Use libraries like scikit-learn, TensorFlow to build advanced predictive algos through Python Build.

SEBI-Compliant Infrastructure

Our strategy onboarding, documentation, and RA partner workflows are designed in line with SEBI’s regulations.

Enterprise-Ready Infra

Scalable backend, white-label dashboards, RA management tools, and API support to serve 10 or 10,000 clients.

Ready-to-Use, No DevOps Needed

Fully cloud-managed. Just build and deploy. You take care of your strategy while we take care of the entire tech for you.

External Signal Integrations

Execute your strategies by taking signals from TradingView, Chartink, Excel, APIs or your existing setup.

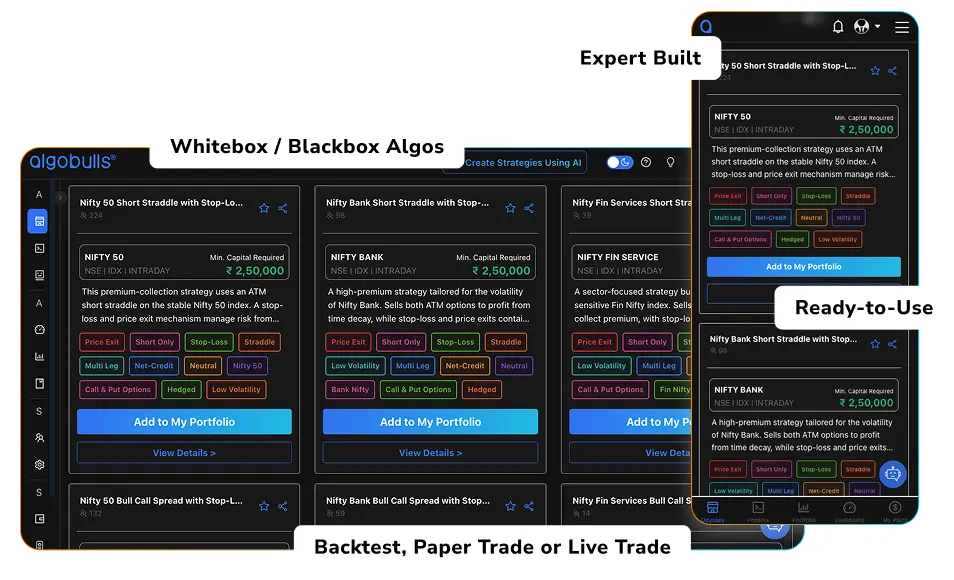

Backtesting, Paper & Live Trading

All mode of executions from one platform without changing a single line of code.

AlgoBuddy Support

AI chatbot trained on user queries and expert insights to help you algo trade effortlessly.

What You Can Use?

PHOENIX – Strategy Building, Your Way

With Phoenix, you can build strategies using:

- Copilot (AI Builder) – Just describe your idea in English to generate your strategy code

- Classic Build (No-Code) – Use dropdowns or AI to create and test logics instantly

- Pro Build (We Build for You) – Share your logic, we develop it end-to-end for you to algotrade efficiently

- Python Build (Code It Yourself) – For quants and developers who prefer to have the flexibility of coding their strategies

ODYSSEY – Choose from a range of expert curated strategies

With Odyssey, you can:

- Choose Whitebox Algos – Ready-made strategies created by expert strategists and logics openly shared for better decision making.

- List your strategies as a Strategy Creator – As a Strategy Creator, you can share your strategies on Odyssey for the world to use.

💬 Have a question? Ask AlgoBuddy — Your Smart Algo Assistant

Our AI-powered chat bot can help you with:

- Choosing the right product

- Understanding platform features

- Clarifying strategy-building steps

- Live help—24/7

Try Phoenix Copilot Now - No Login Required !

Experience the future of Algo Trading. It's easy to get started. Chat with our AI now and backtest your first trading idea 👇

Features that matter

100% Automation

No manual execution. Your logic, fully automated.

AI & ML Strategy Capabilities

Just type your idea. Our AI builds your strategy.

Backtesting & Paper Trading

Test with historical and live market data.

Enterprise-Grade Security

Your data and assets protected by industry-leading security protocols.

Zero Infra Maintenance

Focus on trading while we handle all infrastructure and platform maintenance.

Multi-Strategy Support

Run multiple trading strategies simultaneously across different assets and timeframes.

Full Analytics & Trade Logs

Comprehensive insights into your trading performance with detailed logs and metrics.

TradingView / Chartink / API Signal Integration

Seamlessly connect with popular trading platforms and data providers.

Want to Launch Your Own Algo Desk or Client Execution Platform?

We offer a full-stack enterprise solution for:

Broking Houses

Increase trading volume, client retention

RA & PMS Firms

Automate and distribute research-based strategies

Fintech Platforms

Embed or integrate algo infra via APIs or SDKs

White-Labeled Solutions

Offer AlgoBulls under your own brand

Multi-User Management

Capital control, access roles, live logs

TRUST & COMPLIANCE

SEBI-Aligned Framework

We follow regulatory standards across onboarding, documentation, RA collaborations, and risk management.

Compliance-Ready Workflows

From disclaimers to logs, every component is built for auditability and transparency.

Trusted by Industry Leaders

Used by Registered Advisors, SEBI-Registered Analysts, and Broker Partners.

$1+ Billion

Live Trading Volume

1+ Million

Live Orders

1K+

Direct Clients

1M+

Clients Across Enterprises

1+

Supported Broking Houses

1+

OMS Vendors Supported

Testimonials

Don’t just take our words for it

“AlgoBulls helped us launch our own algo platform under our brand in under 30 days.”

“Our research team now delivers live algos to clients with zero manual intervention.”

“I built and deployed my first Python strategy without worrying about infra or brokers.”

Our Achievements

A Legacy of Trust and Performance

The Best Algo Trading Platform – 100% Regulatory Compliance for Secure & Hassle-Free Trading

"Winner, Emerge 50 Awards"

NASSCOM, 2024

"Best Automated Trading Software"

Runner-up, Benzinga Fintech Awards 2024

"Fintech Startup of the Year"

Finalist, India Fintech Awards 2024

"Best Paper Trading Platform"

Finalist, Benzinga Fintech Awards 2024