Imagine pushing a Ferrari to 300 km/h with nothing but a handbrake to protect you. 🎢

Reckless? Absolutely.

But that’s exactly what many traders do when they dive into algorithmic trading armed only with a basic stop-loss.

In a world where markets move in milliseconds, relying on a single safety net isn’t just risky—it’s a guaranteed disaster waiting to happen.

Algorithmic trading comes with unique risks, from technical failures to market volatility, and successful traders understand that protecting capital requires a multi-layered approach. Today's market conditions demand more nuanced strategies that can adapt to changing volatility, manage correlation risks, and protect against black swan events.

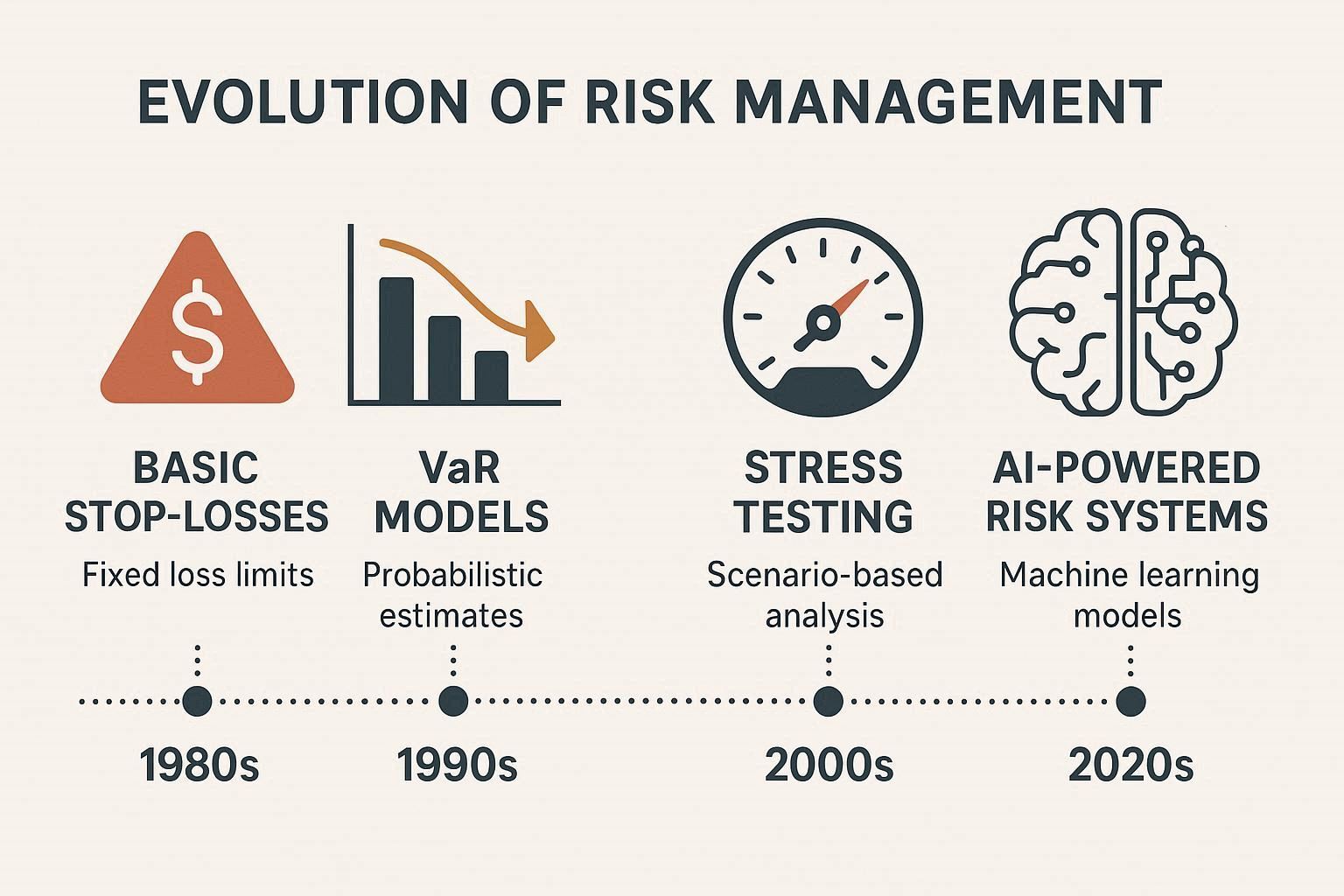

The Evolution of Risk Management in Algorithmic Trading

Traditional risk management relied heavily on simple stop-loss orders—predetermined price levels that would automatically exit a position when losses reached a certain threshold. However, modern algorithmic trading operates in an environment where milliseconds matter, correlations shift rapidly, and market structures evolve constantly.

The limitation of relying purely on stop-loss orders becomes apparent during volatile market conditions. Flash crashes, gaps, and slippage can render traditional stops ineffective, leaving portfolios exposed to significant losses. This is where advanced risk management techniques become indispensable.

Position Sizing: The Foundation of Risk Control

Position sizing refers to the process of determining how much capital to allocate to each trade. Effective position sizing not only controls potential losses but also optimises risk-adjusted returns, playing a pivotal role in the long-term success of any trading strategy.

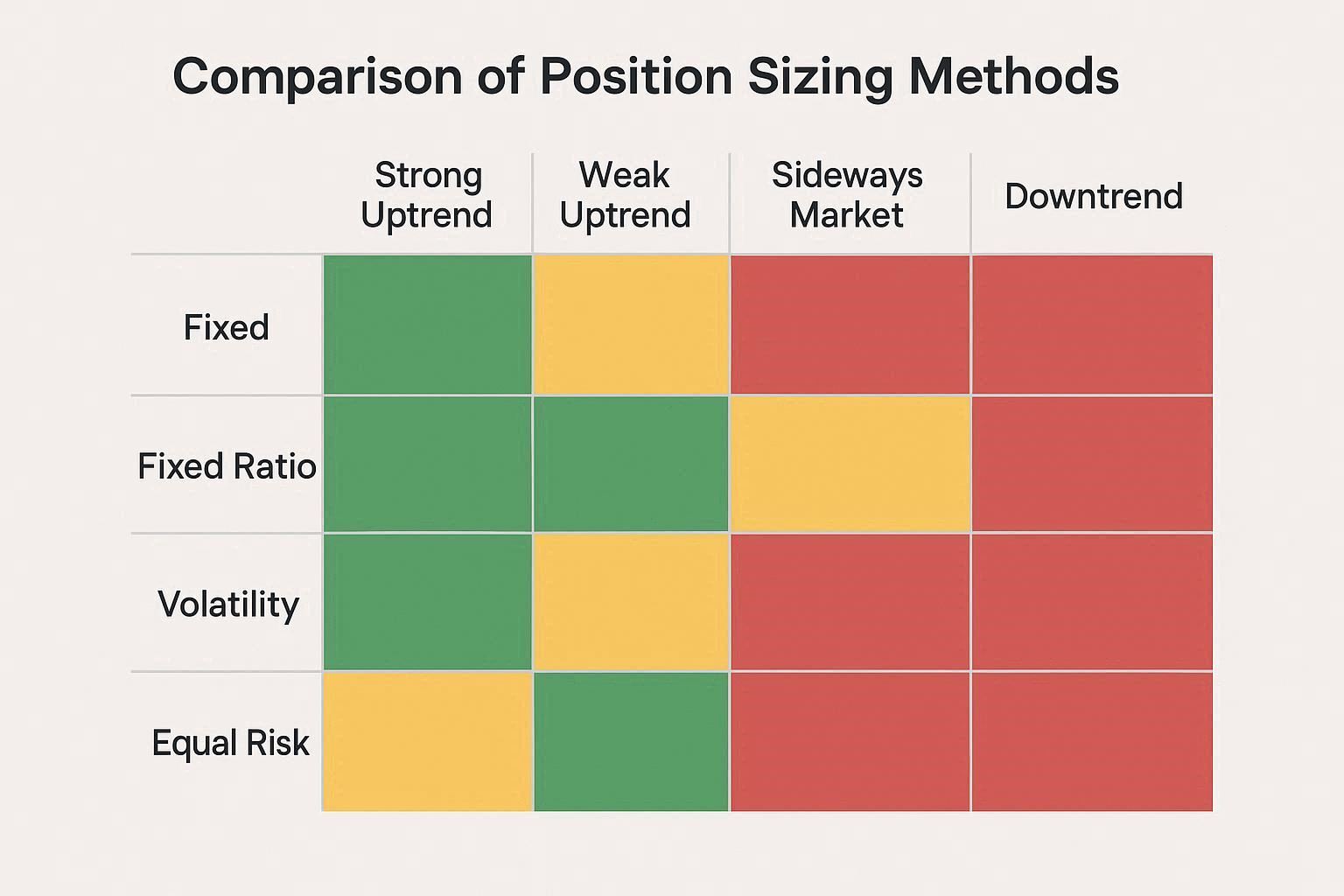

Dynamic Position Sizing Techniques

Fixed Percentage Method The most straightforward approach involves risking a fixed percentage of your total capital on each trade—typically 1-2% for conservative strategies. This method ensures that no single trade can devastate your portfolio, regardless of market conditions.

Volatility-Based Sizing This sophisticated approach adjusts position sizes based on the current volatility of the instrument. During high volatility periods, position sizes are reduced to maintain consistent risk levels. Popular approaches to position sizing in algorithmic trading include adjusting the position size based on the volatility of the instrument (e.g., using ATR).

Kelly Criterion Application For mathematically-minded traders, the Kelly Criterion provides an optimal position sizing formula that maximises long-term growth whilst minimising the risk of ruin. This approach considers both win probability and average win/loss ratios.

Portfolio-Level Position Management

Beyond individual trade sizing, sophisticated risk management requires portfolio-level thinking. This involves:

- Correlation Analysis: Ensuring positions aren't inadvertently concentrated in correlated assets

- Sector Exposure Limits: Preventing overexposure to specific market sectors

- Geographic Diversification: Managing currency and country-specific risks

Want to implement these strategies with precision?

🚀 AlgoBulls is built for you—start your journey today.

Advanced Stop-Loss Strategies

Whilst we're moving beyond basic stop-losses, enhanced versions remain valuable tools in your risk management arsenal.

Trailing Stop-Loss Systems

Traditional trailing stops move in one direction only. Advanced algorithmic implementations can incorporate:

- Volatility-adjusted trailing distances that expand during volatile periods

- Time-based stop adjustments that tighten stops as positions age

- Profit protection mechanisms that lock in gains at predetermined levels

Dynamic Stop-Loss Algorithms

Dynamic stop-loss and take-profit algorithms tailored to each asset represent a significant advancement over fixed stops. These systems consider:

-

Real-time volatility measurements – Continuously track price fluctuations to adjust stops according to current market turbulence.

-

Support and resistance levels – Use key price zones where buying or selling pressure is historically strong to refine stop placement.

-

Market microstructure patterns – Factor in order book dynamics, liquidity, and trade flows that influence short-term price moves.

-

Time-of-day volatility variations – Adapt stops based on predictable volatility changes during market open, close, or news hours.

Real-Time Risk Monitoring and Portfolio Controls

Modern risk management demands real-time monitoring capabilities that can identify and respond to threats faster than human traders ever could.

Key Metrics to Monitor

Value at Risk (VaR) VaR calculations help quantify the maximum expected loss over a specific time horizon with a given confidence level. Advanced implementations update VaR continuously throughout the trading day.

Maximum Drawdown Tracking Monitoring current drawdown levels against historical maximums helps identify when strategies may be experiencing unusual stress.

Sharpe Ratio Monitoring Real-time Sharpe ratio calculations help identify when risk-adjusted returns are deteriorating, potentially signalling the need for strategy adjustments.

Automated Risk Controls

Sophisticated platforms implement automatic risk controls that activate when predefined thresholds are breached:

- Position size reduction when volatility spikes

- Strategy suspension when drawdowns exceed limits

- Portfolio rebalancing when correlations shift dramatically

Stress Testing and Scenario Analysis

Professional risk management requires understanding how your strategies perform under extreme conditions, situations that historical data might not fully capture.

Monte Carlo Simulations

Monte Carlo analysis runs thousands of hypothetical scenarios to understand the range of potential outcomes for your trading strategies. This helps identify:

- Worst-case scenario probabilities

- Capital requirements for different confidence levels

- Strategy robustness across various market conditions

Historical Stress Testing

Ongoing stress testing of portfolios and algorithms involves replaying your current strategies through historical crisis periods:

- 2008 Financial Crisis scenarios

- COVID-19 market disruption periods

- Flash crash events

- Interest rate shock scenarios

Forward-Looking Scenario Planning

Beyond historical testing, sophisticated risk management considers potential future scenarios:

- Central bank policy changes

- Geopolitical risk events

- Technology disruption impacts

- Regulatory changes

To understand how thorough testing validates strategy effectiveness, our blog on Backtesting Fundamentals: The Power of Strategic Trading explores these concepts in depth.

Correlation and Portfolio Risk Management

Individual position risk management is only part of the equation. Portfolio-level risks often arise from hidden correlations that can cause seemingly diversified positions to move in tandem during stress periods.

Dynamic Correlation Monitoring

Correlations between assets change over time, particularly during market stress. Advanced risk management systems continuously monitor:

- Rolling correlation coefficients

- Principal component analysis

- Cluster analysis for identifying relationship changes

- Regime detection algorithms

Hedging Strategies

Smart hedging to lower risk and optimise performance (including derivatives like options and futures) provides another layer of portfolio protection:

Dynamic Hedging Automated systems that adjust hedge ratios based on:

- Portfolio delta exposure

- Volatility changes

- Time decay considerations

- Market regime shifts

Cross-Asset Hedging Using relationships between different asset classes to provide portfolio protection that remains effective even when traditional correlations break down.

Technology and Infrastructure Risk Management

Algorithmic trading introduces unique technology risks that traditional discretionary trading doesn't face. These require specific risk management approaches.

System Redundancy and Failsafes

Professional algorithmic trading operations implement:

- Backup trading systems that can take over seamlessly

- Data feed redundancy to prevent trading on stale information

- Network connectivity backups to ensure continuous market access

- Automated kill switches that can halt all trading in emergencies

Operational Risk Controls

Beyond technology, operational risks require management:

- Regular algorithm performance reviews

- Version control for trading code

- Audit trails for all trading decisions

- Regular disaster recovery testing

Machine Learning and AI in Risk Management

The latest advancement in algorithmic trading risk management involves artificial intelligence and machine learning systems that can identify patterns and risks that traditional methods might miss.

Adaptive Risk Models

Machine learning algorithms can uncover subtle trends that might go unnoticed by human traders. They can also adapt to evolving market conditions, ensuring more accurate and timely risk assessments.

Modern AI-powered risk systems can:

- Identify regime changes in real-time

- Adjust risk parameters automatically

- Detect anomalous patterns that precede market disruptions

- Learn from past risk management decisions

Predictive Risk Analytics

Rather than simply reacting to risk, AI systems can predict potential risk scenarios:

- Early warning systems for market stress

- Predictive models for volatility spikes

- Sentiment analysis integration

- Alternative data incorporation

For traders interested in incorporating AI into their strategies, our comprehensive guide on AI in Trading: Separating Hype from Reality provides valuable insights into practical AI applications.

Regulatory Compliance and Risk Management

With regulatory scrutiny of algorithmic trading increasing worldwide, risk management systems must also ensure compliance with evolving regulations.

SEBI Compliance Requirements

Indian algorithmic traders must navigate specific regulatory requirements. Algorithmic risk management in trading involves systematically identifying and mitigating potential risks linked to automated trading strategies, aiming to enhance reliability and efficiency while minimising potential losses.

Key compliance areas include:

- Pre-trade risk checks

- Position limit monitoring

- Audit trail maintenance

- Regular risk assessment reporting

For detailed guidance on navigating these requirements, our blog on Understanding SEBI's New Algo Trading Regulations for Retail Investors provides comprehensive coverage of compliance obligations.

Implementing Advanced Risk Management: Practical Steps

Moving from theory to practice requires a systematic approach to implementing advanced risk management techniques.

Assessment and Planning

Current State Analysis

- Evaluate existing risk management practices

- Identify gaps in risk coverage

- Assess technology capabilities

- Review historical performance under stress

Risk Framework Design

- Define risk tolerance levels

- Establish monitoring frequencies

- Create escalation procedures

- Design reporting mechanisms

Technology Selection and Implementation

Choosing the right platform is crucial for effective risk management implementation. Consider factors such as:

- Real-time monitoring capabilities

- Integration with existing systems

- Scalability for portfolio growth

- Support for advanced risk models

From beginner-friendly tools to advanced customization, AlgoBulls gives you everything you need for smarter risk management.

📊 Join today and take control of your trading.

Continuous Improvement

Risk management isn't a set-and-forget system. Successful implementation requires:

- Regular backtesting of risk models

- Performance attribution analysis

- Model validation and updating

- Team training and development

Building Your Risk Management Arsenal

As we've explored, effective algorithmic trading risk management extends far beyond simple stop-loss orders. The most successful traders employ a comprehensive approach that includes:

- Dynamic position sizing that adapts to market conditions

- Advanced stop-loss strategies that consider volatility and market structure

- Real-time risk monitoring with automated controls

- Comprehensive stress testing and scenario analysis

- Portfolio-level correlation management

- Technology infrastructure protection

- AI-powered predictive risk analytics

- Regulatory compliance integration

The complexity of modern markets demands equally sophisticated risk management approaches. However, the good news is that platforms like ours - AlgoBulls, make these advanced techniques accessible to retail traders, providing institutional-quality risk management tools without the complexity of building systems from scratch.

For beginners looking to start their algorithmic trading journey with proper risk management from day one, our guide on Algo Trading for Beginners: How to Start Algo Trading as a Retail Investor provides a solid foundation, whilst our analysis of Algo Trading Risks and How to Manage Them: A Trader's Guide offers additional insights into risk mitigation strategies.

The Future of Risk Management

As markets evolve and technology advances, risk management techniques will continue to become more sophisticated. Emerging trends include:

- Quantum computing applications for complex risk calculations

- Blockchain-based audit trails for enhanced transparency

- ESG risk integration for sustainable trading practices

- Cross-market risk analytics incorporating global interdependencies

Staying ahead of these developments requires partnering with platforms that invest in cutting-edge risk management research and development. AlgoBulls continues to evolve its risk management capabilities, ensuring that traders have access to the latest advances in portfolio protection techniques.

Conclusion: Beyond Basic Protection

Successful algorithmic trading requires moving beyond the mindset that stop-loss orders alone provide adequate protection. The strategies we've explored—from dynamic position sizing to AI-powered risk analytics—represent the new standard for professional risk management.

The key is to start with a solid foundation and gradually implement more sophisticated techniques as your trading operation grows. Whether you're just beginning your algorithmic trading journey or looking to enhance existing risk management practices, the most important step is to begin implementing these advanced strategies today.

Remember: in algorithmic trading, your risk management system is ultimately what determines your long-term success. By implementing the comprehensive approaches outlined in this guide, you'll be well-positioned to navigate whatever challenges the markets present whilst protecting and growing your capital.

Ready to trade with professional-grade risk management?