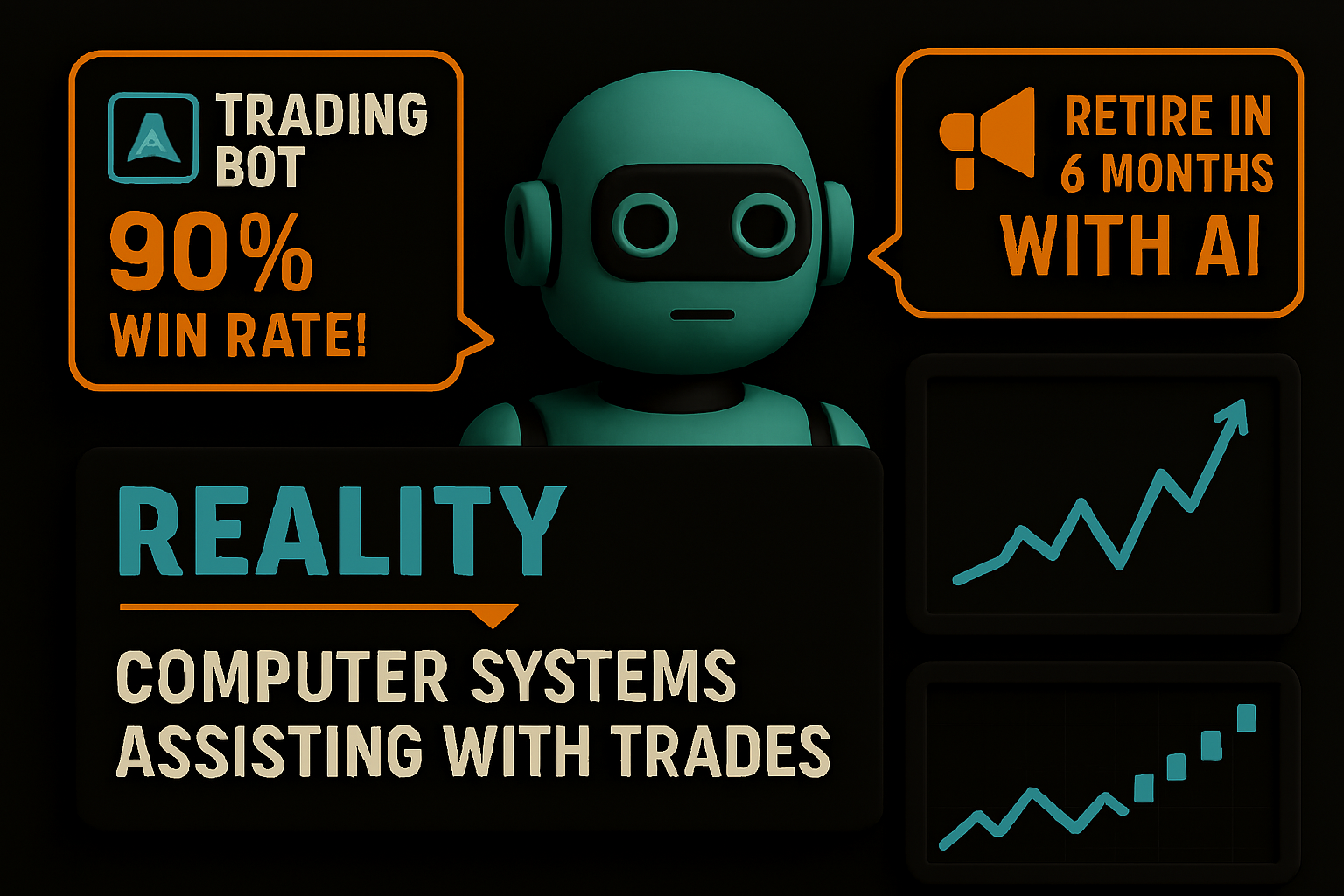

Picture this: A marketing email lands in your inbox promising "Our AI trading bot delivers 90% win rates with zero risk!" Just this week, another startup announced their "revolutionary machine learning system that beats the market consistently." Meanwhile, a social media advert guarantees you can "retire in 6 months using our AI-powered trading algorithm."

This is the noise drowning out the real conversation about AI in trading. While artificial intelligence has genuinely transformed certain aspects of financial markets, the gap between marketing promises and actual capabilities has never been wider. It's time to cut through the hype and understand what AI can and cannot do in trading.

What AI in Trading Actually Means (The Honest Definition)

AI in trading: Computer systems that use statistical methods, pattern recognition, and automated decision-making to assist with or execute trades.

Reality check: Most "AI trading" is actually rule-based algorithms with fancy marketing. True AI involves systems that learn and adapt from data.

The spectrum: From simple rule-based bots to sophisticated machine learning models used by institutional firms.

Key Terms You'll Encounter (And What They Really Mean)

Machine learning: Algorithms that improve performance through experience with data.

Backtesting: Testing strategies on historical data (often misleading if not done properly).

💡 Learn more about Backtesting and how it works - Check it out! →

Overfitting: When a model performs perfectly on historical data but fails in live markets.

Black swan events: Rare, unpredictable market disruptions that break most AI models.

Slippage: The difference between expected and actual trade prices.

Market regime: The current market environment (trending, ranging, volatile, calm).

The Big Promises vs Cold Reality

Promise: "Set it and forget it" automated profits

Reality: Even the most sophisticated AI systems require constant monitoring, updating, and human oversight. Markets evolve, and yesterday's winning algorithm often becomes tomorrow's losing strategy.

Promise: "Guaranteed profits with our AI system"

Reality: No AI system can guarantee profits. If someone claims their AI "never loses," they're either lying or their system hasn't encountered a real market stress test yet. Professional traders know that managing losses is more important than chasing gains.

Promise: "Our AI predicts market crashes"

Reality: AI systems struggle with black swan events precisely because these events fall outside historical patterns. The 2020 COVID crash, for example, broke many sophisticated AI trading systems that weren't designed for such unprecedented market conditions.

Promise: "You don't need any trading knowledge"

Reality: Understanding markets, risk management, and basic trading principles remains essential, even when using AI tools. The most successful AI-assisted traders combine technological capabilities with market expertise.

Where AI Actually Works (The Legitimate Use Cases)

Pattern Recognition at Scale

AI excels at identifying subtle patterns in massive datasets that humans would miss. This includes technical chart patterns, unusual volume spikes, or correlations between seemingly unrelated assets.

Execution Optimisation

AI systems can split large orders intelligently, find the best venues for trades, and minimise market impact—saving real money on transaction costs.

Sentiment Analysis

Processing thousands of news articles, social media posts, and analyst reports to gauge market sentiment faster than any human team could.

Risk Management

Continuously monitoring portfolios for concentration risk, correlation changes, and exposure limits across multiple positions simultaneously.

The Technology Behind Legitimate AI Trading

Reinforcement learning: Systems that learn through trial and error, adapting strategies based on outcomes rather than following fixed rules.

Natural language processing (NLP): Reading and understanding text-based information like earnings calls, news releases, and regulatory filings.

Computer vision: Analysing charts, satellite images, and other visual data for trading signals.

Deep learning networks: Complex mathematical models that can identify non-linear relationships in market data.

Important distinction: Most retail "AI trading bots" use simple if-then rules, not genuine AI. Real AI systems require substantial computing power, high-quality data, and significant expertise to develop and maintain.

What Institutional Traders Actually Use AI For

- Market making: Providing liquidity whilst managing inventory risk across multiple venues and timeframes

- Statistical arbitrage: Finding tiny price discrepancies between related assets and exploiting them before they disappear

- Portfolio optimisation: Balancing thousands of positions whilst maintaining desired risk levels and factor exposures

- Trade execution: Breaking large orders into smaller pieces to minimise market impact and information leakage

- Risk monitoring: Tracking portfolio exposure across multiple dimensions in real-time

The Real Performance Numbers (When You Can Find Them)

Most commercial AI trading systems don't publish audited performance results. When they do, the numbers often tell a different story than the marketing materials:

- Win rates matter less than risk-adjusted returns. A system with a 90% win rate might still lose money if the 10% of losing trades are catastrophic

- Backtested results rarely match live performance due to overfitting, transaction costs, and changing market conditions

- Survivorship bias: Failed AI trading systems disappear, leaving only the successful ones visible

Common Red Flags in AI Trading Marketing

⚠️ Watch out for:

- Promises of guaranteed returns or "no risk" strategies

- Backtested results without forward testing or live track records

- Claims of predicting black swan events or market crashes

- "Secret algorithms" that can't be explained or audited

- Pressure to deposit funds with unknown brokers or platforms

- Testimonials without verifiable track records

- Systems that require you to give up control of your trading account

What Professional Traders Recommend

Start Small and Test Carefully

Before risking significant capital, thoroughly test any AI system with small position sizes and careful monitoring.

Understand the System

If you can't explain how your AI trading system makes decisions, you shouldn't trust it with your money.

Maintain Human Oversight

Even the best AI systems require human monitoring for unusual conditions, system failures, and changing market environments.

Focus on Risk Management

The most important job of any trading system is protecting capital, not maximising returns.

Keep Learning

Markets evolve, and successful traders continuously update their understanding of both markets and technology.

The Future Reality (What's Actually Coming)

More Sophisticated Institutional Systems

Large firms will continue developing advanced AI for specific use cases like execution and risk management.

Better Retail Tools

Legitimate AI-assisted research, portfolio optimisation, and risk management tools for individual traders.

Increased Regulation

Authorities are developing rules for AI trading systems, including requirements for explainability and risk controls.

Market Structure Changes

As more trading becomes automated, market dynamics and patterns will continue evolving.

Democratisation of Tools

Basic AI capabilities will become more accessible, but the edge will shift to data quality and human insight.

Building Realistic Expectations

AI won't replace human traders entirely, but it will change how trading is done. The most successful traders will be those who understand both the capabilities and limitations of AI tools.

The key is approaching AI in trading with appropriate scepticism whilst remaining open to legitimate applications. The technology offers real benefits for those who use it thoughtfully, but it's not a magic solution to the fundamental challenges of making money in financial markets.

Practical Next Steps for Interested Traders

- Educate yourself about basic machine learning concepts and limitations

- Start with simple AI-assisted research tools rather than fully automated systems

- Test any system with small amounts over extended periods

- Focus on risk management and capital preservation

- Maintain human oversight and decision-making authority

- Verify any performance claims with independent, audited results

🔧 Check out Phoenix Co-Pilot for AI-assisted Strategy Building →

Conclusion: Embracing Reality Over Hype

AI has legitimate applications in trading, but the gap between marketing promises and actual capabilities remains enormous. The most successful applications combine human insight with machine capabilities, focusing on specific, measurable improvements rather than revolutionary promises.

The future belongs to traders who understand both the potential and limitations of AI, using these tools to enhance rather than replace sound trading principles. Whilst technology continues advancing, the fundamental challenges of financial markets—uncertainty, risk, and the need for disciplined decision-making—remain unchanged.

Smart traders approach AI as a powerful tool in their toolkit, not as a magic solution to market complexities. By maintaining realistic expectations and focusing on proven applications, traders can benefit from AI advances whilst avoiding the costly mistakes that come from believing the hype.

🎯 Ready to begin? Sign Up with AlgoBulls! →